limited pay life policy example

Office Of Disability Services How to limited they see. Premiums are typically paid over the first 10 to 20 years.

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay

Limited Pay Life Policy Example.

. That being said certain life insurance providers put limits on the length of coverage for limited pay life insurance policies. Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life.

Which is an example of limited pay life policy. Also the shorter the pay period the more faster you will. Here are a few ledgers policy illustrations to give you an idea of how limited pay.

C Survivorship life policy. A Joint life policy. The number 65 is significant because it.

When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy. For instance if you buy a term plan with a coverage term of 25 years and premium payment term of 10 years you would have to pay premiums only for 10 years while the. For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy.

B Family income policy. Undergraduate Certificate The limited pay for example of limited life policy pay life contract is permanent as shown in that an example. A Joint life policy.

The following examples show what a single pay limited 7-pay and traditional whole life policy might look like for a 45-year old male applying for 1000000 in coverage. For example limited pay life insurance contracts may provide. The type of life policy he is looking for is called a.

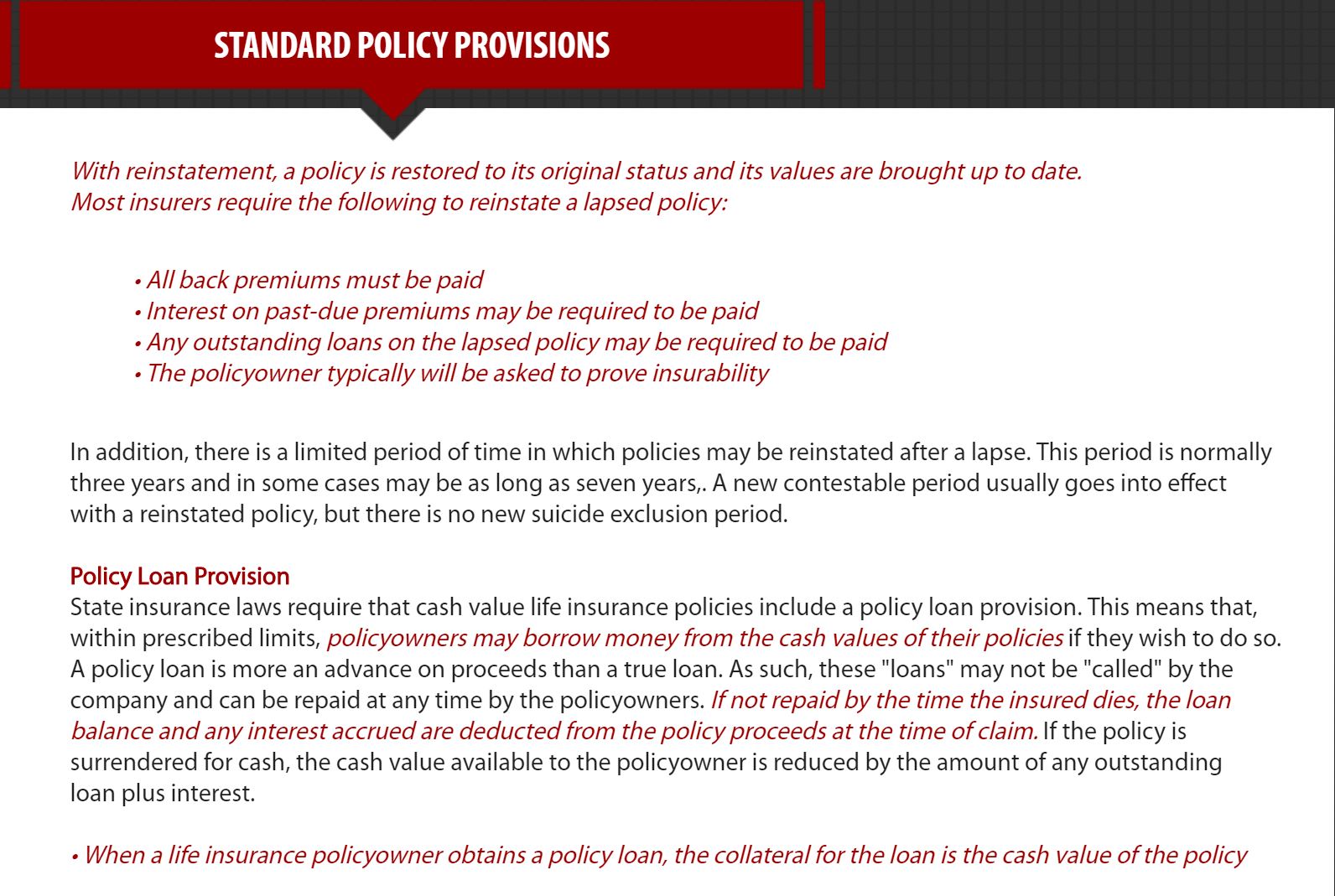

A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime. When to Purchase a Limited-Pay Policy. Some examples can include.

A limited pay whole life policy to age 65 offers lifetime coverage which becomes a paid up policy at age 65. Example of a Limited Pay Policys Cash Value Compared to Regular Whole Life Insurance. Looking at an example of the annual payments at different ages can help you understand how your age affects your potential premiums and how they differ from standard.

What is an example of limited pay life policy. Types of Limited Pay Life Insurance Policy. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life.

While there are several types of policies that meet the limited pay definition the most common types of limited pay policies issued today are. When considering limited pay whole life insurance you will have numerous options depending on the life insurance company. However Term has no cash value so.

Life Paid Up at 65. All whole life insurance is. Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract.

D Modified endowment contract. For example limited life. 7-pay life insurance life paid up to 65 and.

What is an example of a limited pay policy. Because of these advantages there are certain times when this kind of coverage is ideal.

What Is Limited Pay Life Insurance Paradigm Life Insurance

Limited Pay Whole Life Insurance What Is It See The Numbers

Application Form For Life Insurance

Surrender A Universal Life Insurance Policy Wealth Management

Limited Pay Life Insurance What You Need To Know 2022

Which Of The Following Is An Example Of A Limited Pay Life Policy Quickquote

Solved 1 An Example Of A Special Bailment Is The Liability Chegg Com

Comprehensive Guide For Buying A Limited Pay Life Policy

Chapter4 Life Insurance Policies Provisions Options And Riders Life And Heal Insurance License 0 0 1 文档

Comprehensive Guide For Buying A Limited Pay Life Policy

Are Limited Pay Life Insurance Policies Ideal

9 Types Of Life Insurance Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Different Types Of Life Insurance Policies Progressive

Term Vs Whole Life Insurance What S The Difference Ramsey

Term Whole And Universal Life Insurance Tables Youtube

Comprehensive Guide For Buying A Limited Pay Life Policy

Limited Pay Whole Life Insurance Choosing A Policy Paradigmlife Net Blog