proposed estate tax law changes

Reduction of the gift tax exemption to 1 million per person. Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for inflation.

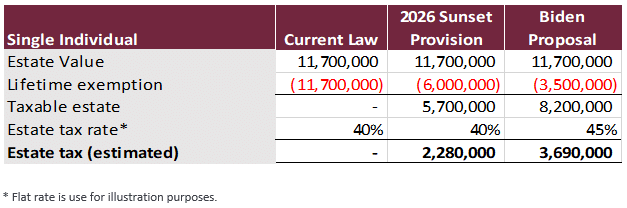

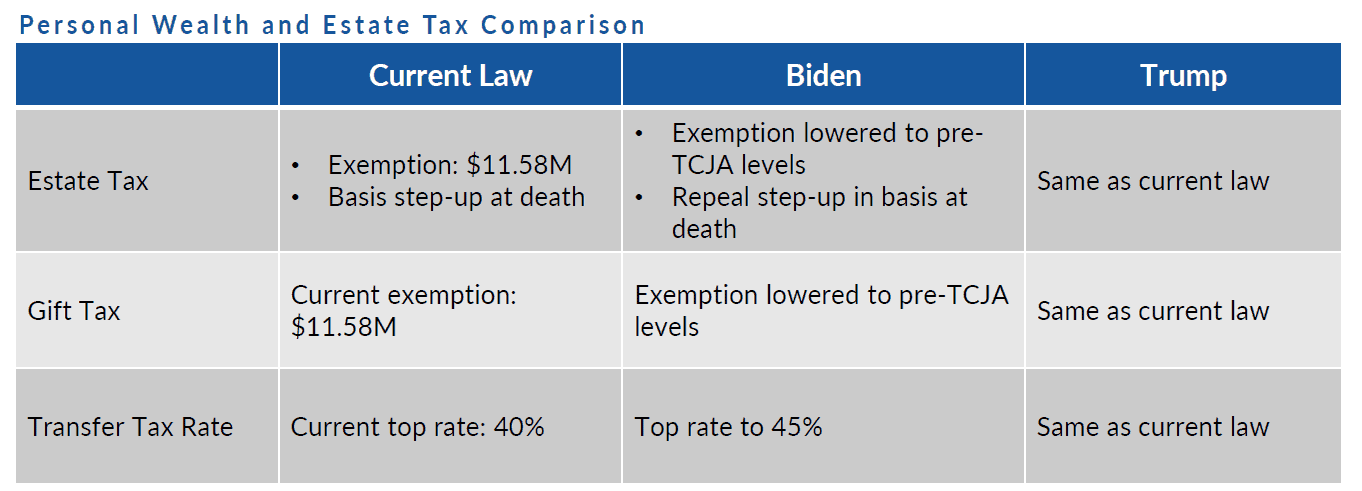

Estate Tax Current Law 2026 Biden Tax Proposal

Reduction in the Estate Tax Exemption.

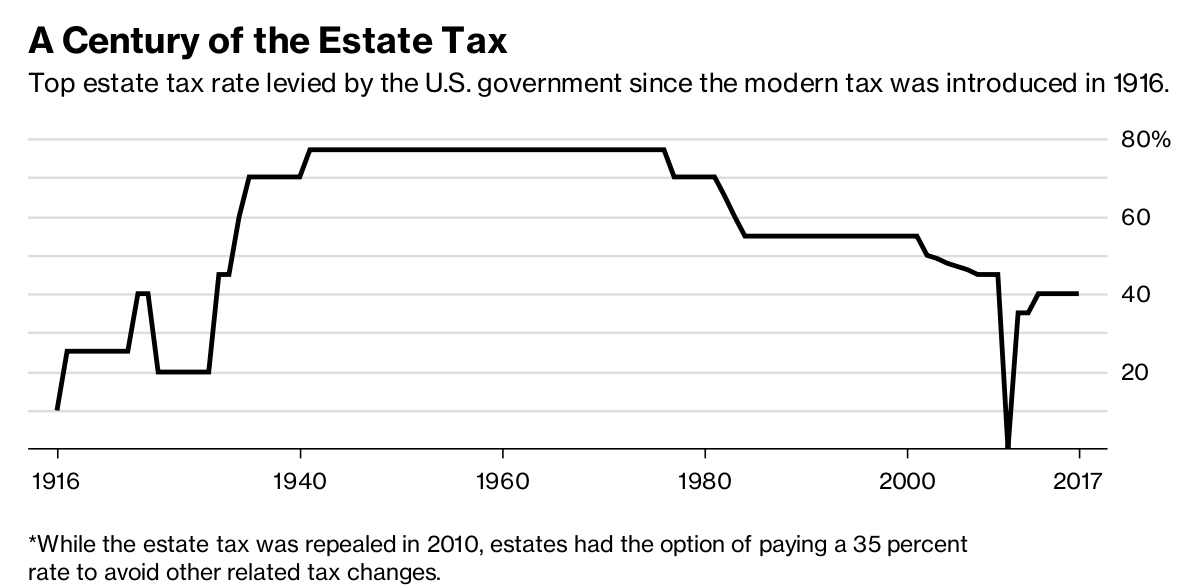

. Federal estate and gift tax are assessed at a flat rate of 40. But it wouldnt be a surprise if the estate tax. This plan reduces that exemption for 2022 and future years to.

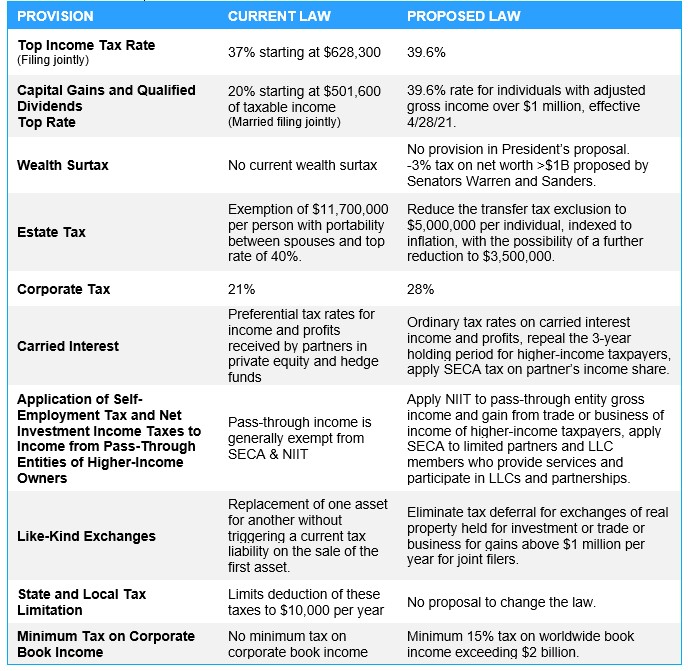

A Democratic State Senator has proposed changes to the SAFE-T Act that will eliminate cash bail in Illinois beginning at the start of next year NBC 5s Mary Ann Ahern. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. Increasing top tax rates for individuals.

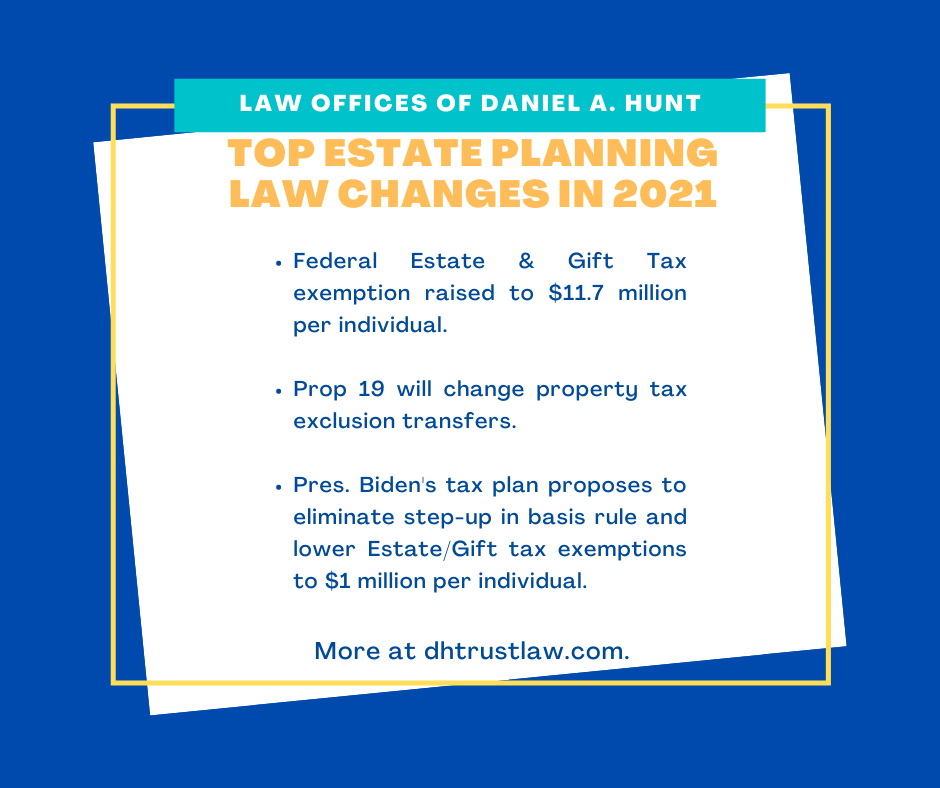

Currently a persons estate is exempt from estate taxes up to 11700000. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Recent Changes to Illinois Estate Planning 2022.

On July 9th 2021 Governor JB. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in 2018. This article will discuss Estate Planning in Illinois and whether there are any recent changes to Estate Planning laws in 2022.

Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted. For the vast majority of Americans the. Gift and Estate Tax systems would no longer be unified.

Proposals to decrease lifetime gifting allowance to as low as 1000000. As we discussed above the first tool we use in an Illinois estate plan to minimize estate tax is to allow couples to take advantage of one anothers exemptions through revocable living trusts. Estate and Gift Tax Exclusion Amount.

Generally there will be an estate tax exemption where estates under a certain set amount will not be subject to a tax. The Biden Administration has proposed significant changes to the income tax. Whether the proposed estate and gift tax changes end up being a typhoon or just an unusually high tide there is no time like right now for clients to reduce their exposure to estate taxes.

Under the SandersBiden bill proposed to be effective beginning January 1 2022 the estate tax exemption amount would be reduced to 3500000 from the present level of. Pritzker signed a bill which changes the Residential Real Property Transfer on Death. Change in the Estate and Gift Tax rates currently a flat.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. This memo does not go into the significant proposed changes to income taxes increased income tax for single and joint filers and an increase in capital gains tax rates. As of 2021 at the federal level the exemption is set at 117 million dollars.

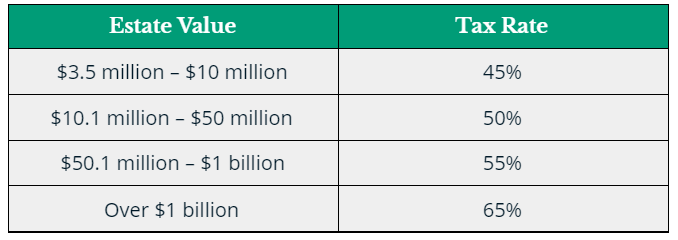

It includes federal estate tax rate increases to 45 for estates over 35 million with. Thankfully under the current proposal the estate tax remains at a flat rate of 40. Read on for five of the most significant proposed changes.

Reduce the current 117 million federal ESTATE tax exemption to 35 million. New Illinois Law Real Property Transfer on Death Instrument Act. The current 2021 gift and estate tax exemption is 117 million for each US.

While there has been a lot of confusion about various estate tax law changes that are currently being proposed in Washington below is a helpful summary of the tax proposals. The children will not pay any federal estate tax assuming that George had made no prior lifetime taxable gifts because the value of Georges assets is less than the 117 million. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Proposed Changes To Income And Estate Tax Laws Satovsky Asset Management Youtube

Proposed Taxable Estate Deduction Changes Dallas Business Income Tax Services

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

Proposed Changes To The Federal Estate Gift Tax Exemption Brmm

Estate Planning Strategies To Consider Ahead Of Biden S Potential Tax Changes

Potential Tax Law Changes Impacting Estate Planning Fredrikson Byron Fredrikson Byron P A

Democrats Propose Expanding Estate Tax Gop Wants To Kill Death Tax Don T Mess With Taxes

Big Tax Changes Are Brewing What You Need To Know Barron S

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Biden Administration May Spell Changes To Estate Tax And Stepped Up Basis Rule Cumberland Legacy Law

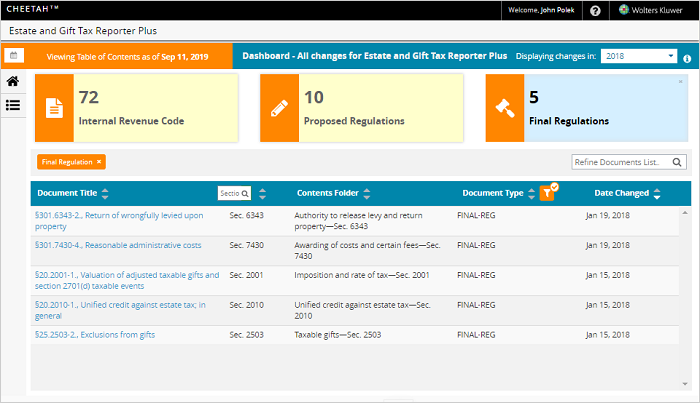

Estates Gifts And Trusts Tax Law Suite Wolters Kluwer

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

Recent Changes In Estate Planning And Gift Tax Laws Retirement Watch

Navigating The Changes To Tax Laws In 2021 University Of Cincinnati

Op Ed Proposed Estate Tax Law Changes Hit Farms Hard El Paso Herald Post

Changes To The Estate Tax Laws Mission Wealth

Estate Tax Law Changes What To Do Now

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

In Light Of House Ways And Means Committee Proposals The Time To Act Is Now