does indiana have estate or inheritance tax

If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state inheritance. In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate.

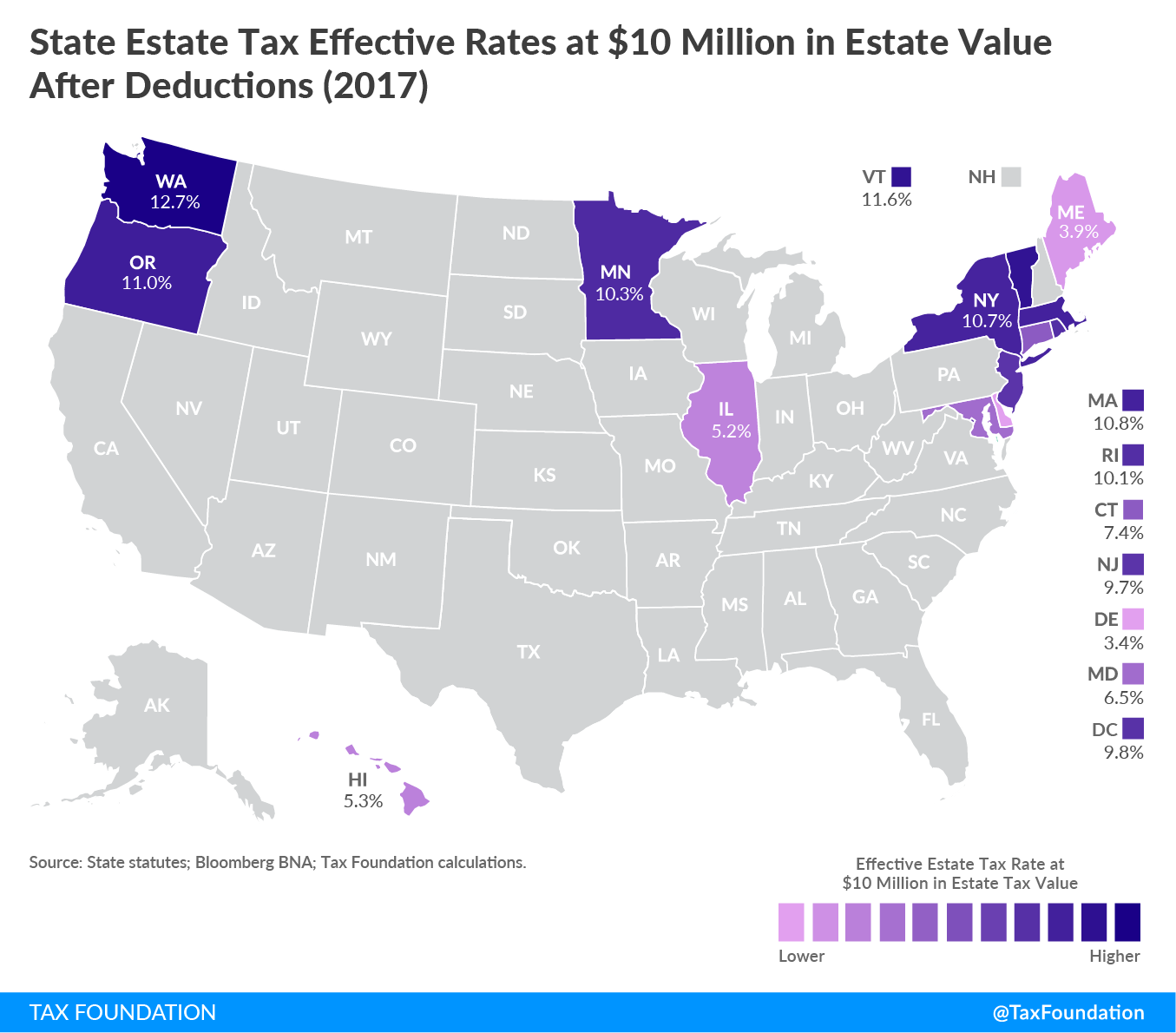

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Hawaii and Washington State.

. The United States tax code and each states estate andor. However other states inheritance laws may apply to you if. Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

Indiana is one of 38 states in the nation that does not have an estate tax. Maryland is the only state to impose both. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012. Top Get helpful tips and. Does Indiana Have Estate Or Inheritance Tax.

No inheritance tax has to be paid for individuals dying after December 31 2012. There is no inheritance tax in Indiana either. There is no inheritance tax in Indiana either.

In 2021 the credit will be 90 and the tax phases out completely. Of course Indiana cannot change federal law and there does remain in existence a Federal Estate Tax. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

Tax Foundation analyst Katherine. In general estates or. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31.

Indiana does not have an inheritance tax nor does it have a gift tax. There is no inheritance tax in Indiana either. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Indiana is one of 38 states in the nation that does not have an estate tax. However other states inheritance laws may apply to you if. The transfer of a deceased individuals ownership interests in property including real estate and personal property may result in the imposition of inheritance tax.

To the extent that there is any good news about a tax because of the credits available to. The inheritance tax exemption was increased from 100000 to 250000 for certain family. Even though there is a state tax assessment.

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. For those who do not plan the amount of Federal. Marylandwhich also has an estate taximposes the lowest top rate at 10 percent.

For example Indiana once had an inheritance tax but it was removed from state law in 2013. Unlike neighboring Wisconsin Michigan Indiana and Missouri Illinois is one of just a dozen states that still have an estate or inheritance tax.

State Estate And Inheritance Taxes Itep

How Do State And Local Sales Taxes Work Tax Policy Center

How To Avoid Estate Taxes With A Trust

Will My Heirs Be Forced To Pay An Inheritance Tax In California

Indiana Inheritance Laws Tips To Keep Wealth In The Family

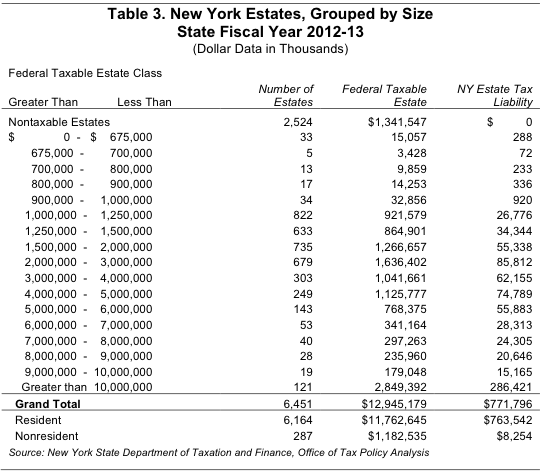

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Transfer On Death Tax Implications Findlaw

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

State Death Tax Hikes Loom Where Not To Die In 2021

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

.png)

Iowa Inheritance Tax Law Explained

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

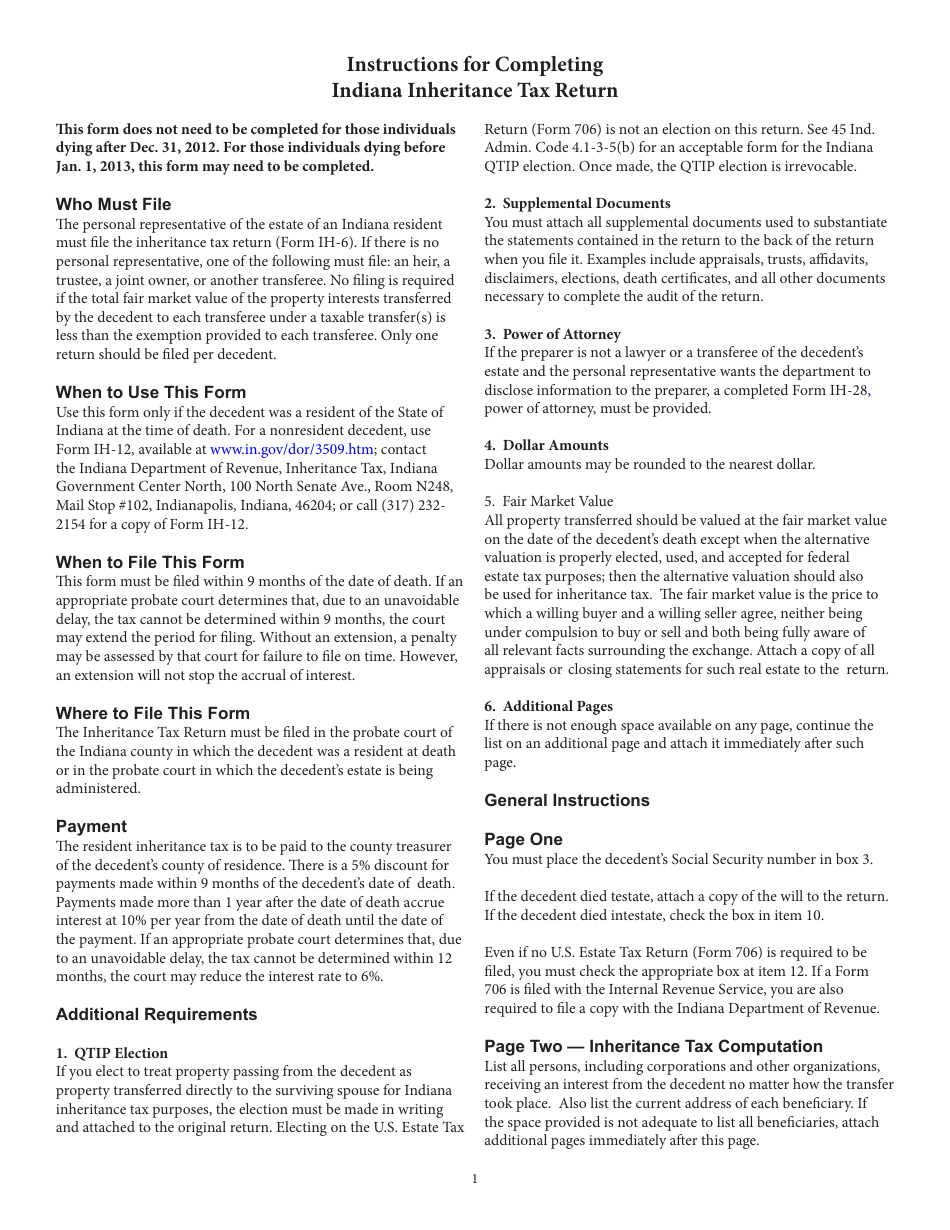

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

State Estate And Inheritance Taxes Itep

What Should I Do With My Inheritance Inside Indiana Business

Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On