omaha ne sales tax rate 2019

A 19-year-old Omaha man was sentenced to prison after pleading guilty to robbery and conspiracy to commit robbery in connection with a 2019 homicide. There is no applicable city tax or special tax.

Sales Taxes In The United States Wikiwand

The Nebraska sales tax rate is currently.

. Local sales taxes may result in a higher percentage. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. There are no changes to local sales and use tax rates that are effective July 1 2022.

New local sales and use taxes. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Form NOL Nebraska Net Operating Loss Worksheet Tax Year 2019.

Repealing the sales tax on groceries has often been proposed in Montgomery but. 58 rows The state sales tax rate in Nebraska is 5500. Iowas is 6 percent.

With local taxes the total sales tax. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The Registration Fees are assessed. Groceries are exempt from the Nebraska sales tax. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. The Omaha sales tax has been changed within the last year. 4 rows Rate.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. For additional information on these boundary changes contact the city clerk of the appropriate city.

There is no applicable county tax or special tax. For tax rates in other cities see Nebraska sales taxes by city and county. You can print a 7 sales tax table here.

Nebraskas sales tax rate is 55 percent. Form 1040XN 2019 Amended Nebraska Individual Income Tax Return. According to the Nebraska Department of Revenue the Dakota County sales and use tax rate will no longer be effective for taxable deliveries made within the Dakota City boundaries as of January 1 2019.

It was lowered 05 from 825 to 775 in March 2022 raised 05 from 775 to 825 in March 2022 and lowered 05 from 825 to 775 in February 2022. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. There are no changes to local sales and use tax rates that are effective January 1 2022.

Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. 1500 - Registration fee for passenger and leased vehicles. The County sales tax rate is.

Form CDN 2019 Nebraska Community Development Assistance Act Credit Computation. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Updated March 3 2022 The following cities have adopted ordinances or made plat changes which have modified their city boundaries.

For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019.

Local sales and use tax increases to 2 bringing the combined rate to 75. A new 1 local sales and use tax takes effect bringing the combined rate to 65. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

The Omaha sales tax rate is. Lawmakers are questioning a proposal that would raise Nebraskas state sales tax and steer the extra revenue into tax credits for low-income residents and property owners. The 775 sales tax rate in Omaha consists of 65 Arkansas state sales tax and 125 Boone County sales tax.

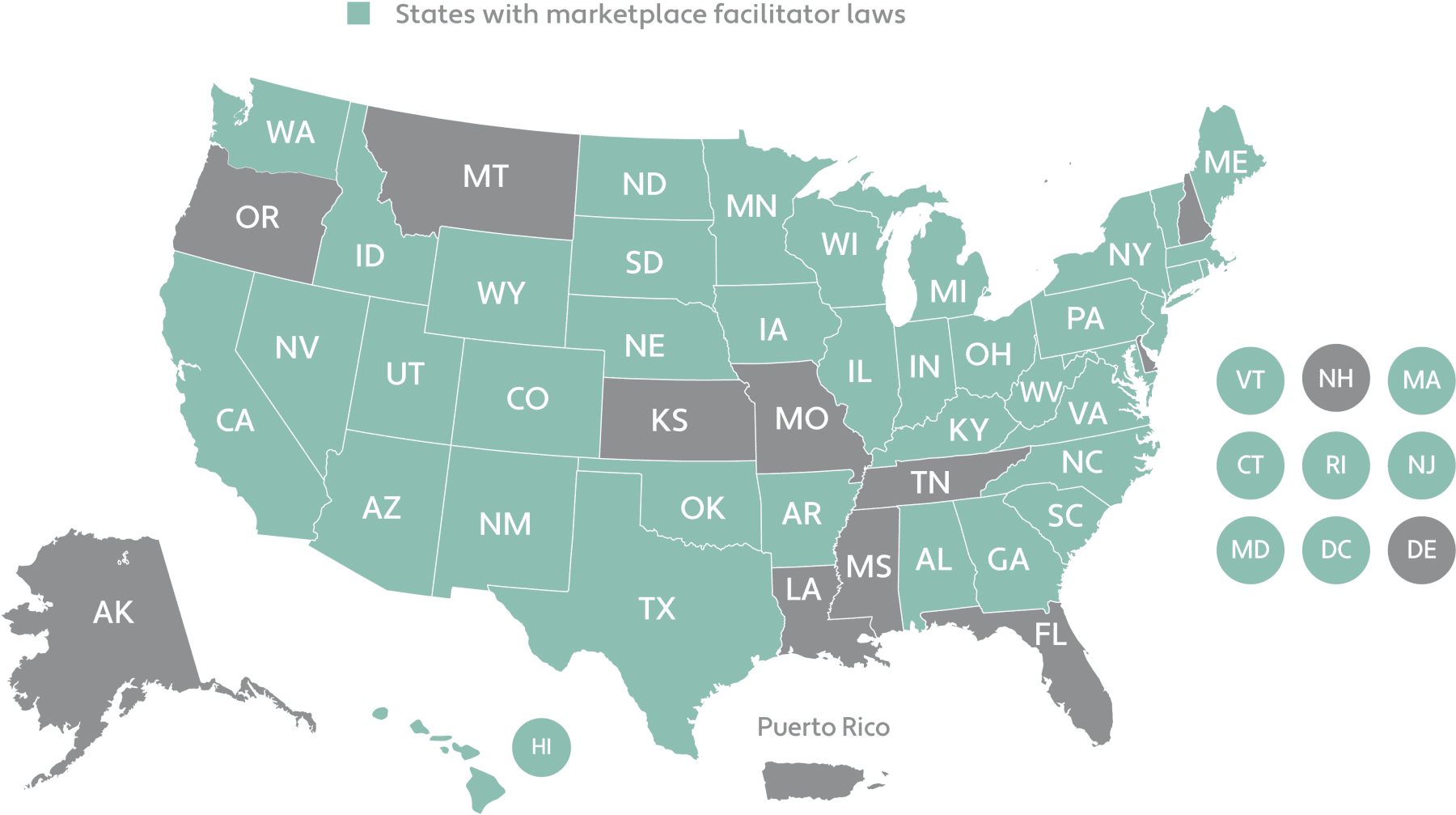

05 lower than the maximum sales tax in NE. As of January 1 2019 Nebraska requires certain out-of-state businesses to. Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019.

For city sales and use tax purposes only these boundary changes are effective on the date identified in the column titled Effective Date. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055.

The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. A new 1 local sales and use tax is being imposed in the following locations bringing the total state and local rate in each to 65. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Cell Phone Taxes And Fees 2021 Tax Foundation

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

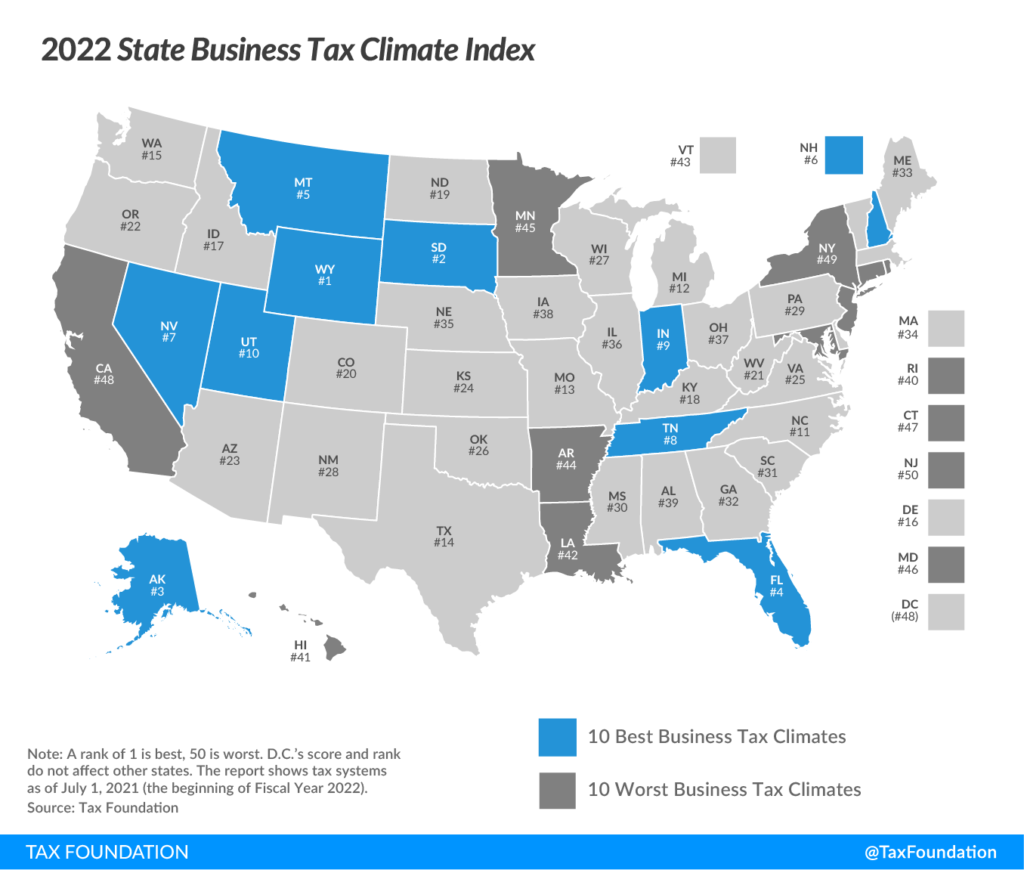

Nebraska Drops To 35th In National Tax Ranking

Should You Move To A State With No Income Tax Forbes Advisor